3 October 2025

media release

6 months after US tariffs: Spotlighting the super reaction

Six months after the market shock caused by US tariff announcements, a new HESTA member survey has found 43% of members would be more likely to monitor their super balance during volatile market periods.

The figures also reveal around half of respondents reported checking their balance around the time of the tariffs announcement1.

While there is added focus on super returns during times of market turbulence, long-run HESTA data highlight the potential dangers in knee-jerk investment decisions during volatile times. These often happen due to natural biases to feel worse about short-term pain rather than good about long-term gain.

The $100 billion super fund recorded an uptick in investment switching activity compared to average levels at the height of this year's market correction in the week commencing 7 April, just after the April 2 (US time) tariffs announcement.

Analysis of historical data finds investment switching activity has consistently reached highs around the time markets have hit their lowest points in a cycle. This pattern has been observed during the past three major market falls: the COVID pandemic, the inflation-driven correction of 2022, and the correction earlier this year.

Members who switch will predominantly move toward more defensive options, such as Cash and Term Deposits.

HESTA CEO Debby Blakey said while it was natural to feel concerned during market downturns, rushed decisions could harm long-term retirement outcomes.

"We recognise market volatility can be unsettling, but history shows that staying invested through the markets regular ups and downs has delivered strong long-term returns for our members," Ms Blakey said.

"Super is a decades-long investment, and we actively manage our members’ savings, with investments well diversified and built to cope with extreme market events.

“Making snap decisions based on short-term market moves can mean locking in losses and missing out on the eventual market recovery. This can result in tens of thousands of dollars less at retirement.

“If feeling anxious, the best thing to do is seek advice that drives an outcome suited to your individual circumstances, which may vary depending on proximity to retirement. We also recommend engaging with your super more than just during market events.”

HESTA’s analysis of prior crises detail the potential pitfalls in switching to defensive options during a market correction.

If a member with a $100,000 balance switched from the most popular option, the default MySuper Balanced Growth, to the most defensive Cash & Term Deposits option during COVID in 2020, just five years later they could be more than $20,000 worse off in terms of potential retirement savings. This figure assumes they took one year to switch back2 3.

The recovery from volatility earlier this year has also been strong. Between the 2 April announcement of tariffs and 30 September 2025, HESTA’s MySuper Balanced Growth has returned 8.03%, as against 1.82% for the ready-made Cash & Term Deposits option – the most defensive option available4.

HESTA provides regular updates to members during periods of market volatility, while the fund also offers expert super health checks for members at no additional cost.

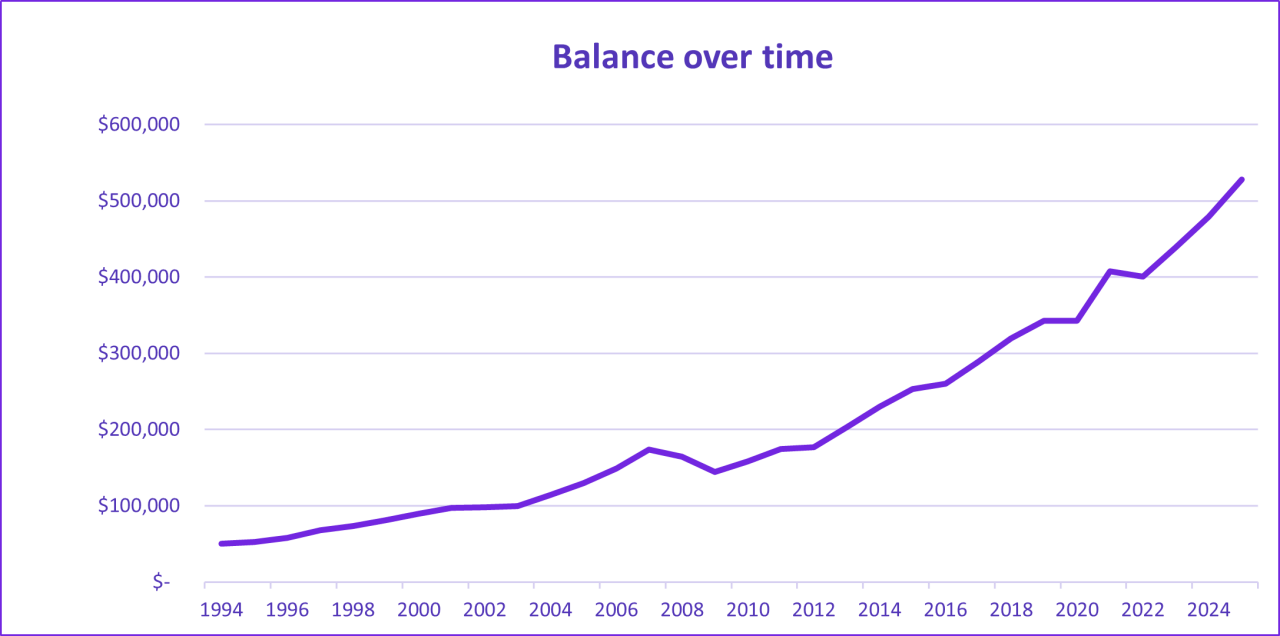

MySuper Balanced Growth Performance over time (net returns, annualised). $50,000 invested to 30 June 20252

Ends

1 Based on responses of 599 members – survey conducted in September 2025.

2 Calculations are performed on a fixed value over the stated date range and do not take into consideration any member transactions (contributions/draw down benefits) or deductions (administration/insurance) or other entitlements (LISTO, Co-Contributions). Returns are based on historical crediting rates and unit prices. Previously named Core Pool. Rounding has been applied to the graph to the nearest dollar. Annualised returns are net of investment fees and costs, transaction costs and taxes. Past performance is not a reliable indicator of future performance.

3 Figure determined based on switching from Balanced Growth to Cash & Term Deposits on 30 June 2020, then switching back on 30 June 2021 and holding until 30 June 2025. Compared to staying invested in Balanced growth the entire five years. Figure would be even higher if switched at peak of COVID market falls in March 2020.

4 Returns are net of investment fees and costs, transaction costs and taxes from 3 April 2025 to 30 September 2025 inclusive. Past performance is not a reliable indicator of future performance. Updated performance for all options can be found at: www.hesta.com.au/investments