Our diversified approach

HESTA is committed to helping our members achieve strong, long-term investment outcomes — a key part of this commitment is our diversified investment approach.

While it's natural to feel more concerned during market downturns, rushed decisions could harm long-term retirement outcomes. It’s important to remember that super is a decades-long investment and at HESTA we actively manage our members’ savings with well-diversified investments, a mitigant against volatility.

Here's the interesting part: analysis of historical data shows investment switching activity has consistently reached highs around the time markets have hit their lowest points in a cycle. Members who switch will predominantly move towards more defensive options such as Cash & Term Deposits. But while this switching may guard against further losses, this approach could also have its pitfalls as markets recover.

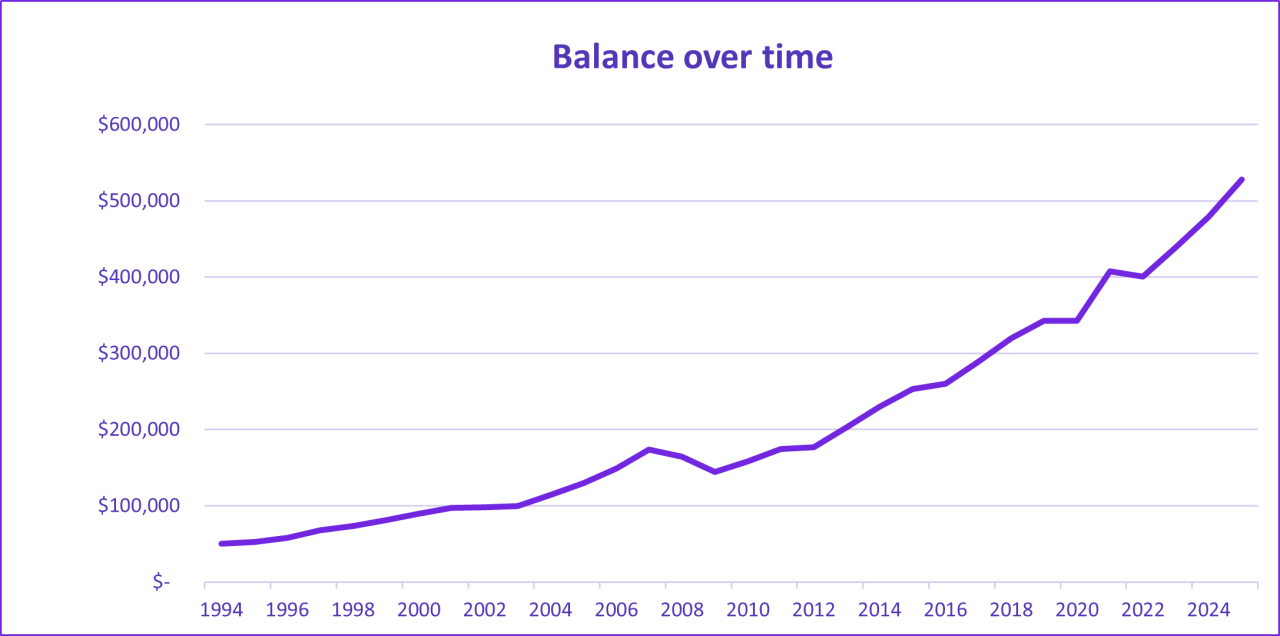

For example, if you'd moved $100,000 from Balanced Growth to Cash & Term Deposits option during the COVID downturn, you might be $20,000 worse off today, just 5 years later. This figure assumes you took one year to switch back2 3.

The good news? Markets tend to bounce back over time. After the April volatility, our Balanced Growth option has more than recovered, returning 8.03% through 30 September 20254, showing that patience can pay off.

Remember, if you're feeling uncertain about your super, we offer super health checks with our experts at no additional cost.

1 Based on responses of 599 members – survey conducted in September 2025.

2 Calculations are performed on a fixed value over the stated date range and do not take into consideration any member transactions (contributions/draw down benefits) or deductions (administration/insurance) or other entitlements (LISTO, Co-Contributions). Returns are based on historical crediting rates and unit prices. Previously named Core Pool. Rounding has been applied to the graph to the nearest dollar. Annualised returns are net of investment fees and costs, transaction costs and taxes. Past performance is not a reliable indicator of future performance.

3 Based on responses of 599 members – survey conducted in September 2025.

4 Returns are net of investment fees and costs, transaction costs and taxes from 3 April 2025 to 30 September 2025 inclusive. Past performance is not a reliable indicator of future performance. Updated performance for all options can be found at: www.hesta.com.au/investments.

HESTA is committed to helping our members achieve strong, long-term investment outcomes — a key part of this commitment is our diversified investment approach.

Read our 2025 performance and market recap, and our deep dive on diversification.

Book an appointment with a superannuation expert at no extra cost.