climate action

Climate change poses a material, direct and current financial risk that is relevant to HESTA’s management of our members’ retirement savings.

how we do this

|

|

We have captured our actions in our Climate change statement: Climate change statement (pdf) To help guide our ongoing commitments, we've developed our Climate Change Transition Plan.

|

|

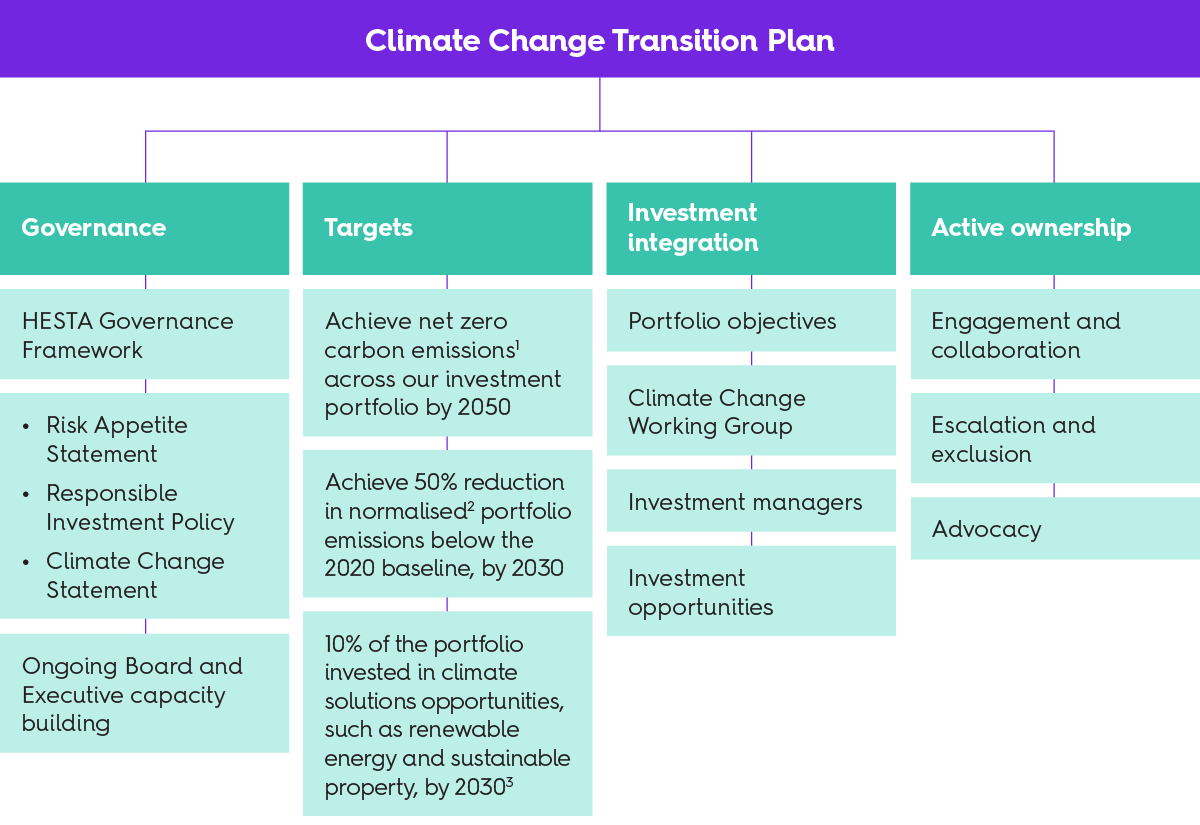

climate change transition plan

To help guide our ongoing commitments, we've developed our Climate Change Transition Plan, which outlines our strategy to:

- achieve net zero carbon emissions1 across our investment portfolio by 2050

- achieve 50% reduction in normalised2 portfolio emissions below the 2020 baseline, by 2030

- 10% of the portfolio invested in climate solutions opportunities, such as renewable energy and sustainable property, by 2030.3

We consider climate change risks and opportunities in a number of ways:

As a large global investor, with investments across a range of geographic regions, economies and asset classes, HESTA cannot diversify away from climate-related impacts.

Because climate change has the potential to impact investment risks and returns, we consider it alongside traditional financial and business risk factors in making investment decisions.

We also take a total portfolio approach as we recognise the impact of climate change can present in many ways. In order to mitigate climate risk and capture climate-related opportunities, we need to achieve change in the real economy. In response, we have developed the following Climate Change Transition Plan to guide our actions.

1 Scope 1 and 2 emissions of portfolio companies.

2 We have chosen normalised carbon emissions (tonnes of CO2e / $m invested) for scope 1 and 2 emissions of portfolio companies, calculated based on enterprise value, to represent our share of real-world emissions.

3 Identification of opportunities has been based upon the Sustainable Development Investment Asset Owner Platform (SDI AOP) Taxonomy. Investments that are aligned to SDG 7, 11.6 and 13 have been included in the baseline. More information available at https://www.sdi-aop.org/sdi-classification.

For further information on these objectives please refer to HESTA’s Climate Change statement.

our progress towards net zero

We've been working hard to manage climate-related risks and capitalise on opportunities in our portfolio. You can find out more about the progress we're making in our video.

Voiceover:

Our purpose is to invest in and for people who make our world better.

We bring our purpose to life by supporting members to face the future with confidence, being a gutsy advocate for a fair and healthy community and delivering investment excellence with impact.

That’s Super with impact ™.

AT HESTA, we use our expertise and influence to deliver strong-long term returns to members, while accelerating our contribution to a more sustainable world.

As responsible investors, we consider how the risk and opportunities of climate change impact our portfolio and the world our members, live work and retire in.

We’ve been working hard to reduce the emissions in our portfolio and the Australian economy, and capitalise on opportunities as we transition to a low carbon economy.

For over two decades we’ve focused on managing climate-related risks.

Our actions include:

- Launching the Eco Pool investment option, now Sustainable Growth, in 2001;

- Implementing select restrictions and exclusions on investments in companies involved in thermal coal, such as listed companies deriving 15% or more revenue from the mining of thermal coal;

- And, we were one of the first major Super funds to announce an emissions reduction target of net zero by 2050 as part of our Climate Change Transition Plan.

This was supported by an interim target of 33% reduction in normalised emissions by 2030; which we’ve proudly achieved in 2022, 8 years ahead of schedule.

Yet, we know the world needs greater action on climate.

This has led us to strengthen our interim target to 50% normalised emissions reductions by 2030.

As we transition to a lower carbon world, we believe there are investment opportunities that will help us to deliver long-term value to our members.

We're aiming to have 10% of the portfolio invested in climate solutions, like renewable energy and sustainable property by 2030.

You can find out more about these targets and the progress we’re making towards our Climate Change Transition Plan on our website at hesta.com.au/climate-action

read our climate disclosure

HESTA biennially publishes comprehensive reporting on the implementation of its Climate Change Transition Plan, in accordance with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

In intervening years, we produce an update which focuses more specifically on HESTA’s progress toward climate targets. This update complements and should be read in conjunction with our comprehensive report for an in-depth look at our approach to managing climate-related risks and opportunities.

learn more about super with impact™

Facing the future with confidence

We use our deep understanding of our members to design information, tools and support to make a meaningful impact on their confidence about the future.

Facing the future with confidence >

Gutsy advocate for a fair and healthy community

We use our collective voice to help address inequities impacting our members and those we see falling behind.

Investment excellence with impact

We use our expertise and influence to deliver strong long-term returns while accelerating our contribution to a more sustainable world.

Investment excellence with impact >

*