Retirement planning for two

HESTA can take the guesswork out of retirement planning for you and your partner.

You can only make one withdrawal of up to $10,000 gross (which means before tax) in a 12-month period if:

You can withdraw any amount if:

The amount is paid and taxed as a lump sum. If you’re under age 60, this is generally taxed between 17% and 22%. If you’re aged over 60, the amount will be tax-free (excluding any untaxed elements). Learn more about eligibility on the ATO website.

The fastest way to apply for a financial hardship payment is through your online account. Log in to your account and go to More actions > Access your super.

Log in to apply for financial hardship >

Read and complete the Financial hardship fact sheet and form (PDF) to apply, then return your completed form and other supporting documentation to us.

The process of accessing your super on compassionate grounds is handled by the Australian Taxation Office (ATO). For the ATO to agree to release the funds from your super, you’ll need to prove you’re unable to meet the expenses for one or more of the following:

The amount is paid and taxed as a lump sum. If you’re under age 60, this is generally taxed between 17% and 22%. If you’re aged over 60, the amount will be tax-free (excluding any untaxed elements).

To apply, access the ATO application form, or visit ato.gov.au linked services in myGov. Alternatively call the ATO on 13 10 20.

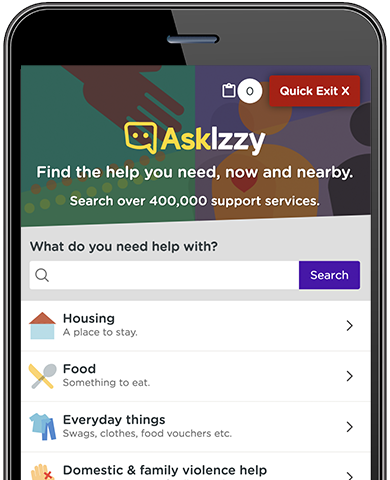

We’ve partnered with Infoxchange, the not-for-profit social enterprise behind Ask Izzy: a free service that helps Australians find and access local support services.

If you need some help outside of super, the Ask Izzy website can connect you with nearby support services across Australia. You can search for over 450,000 services close to you, including financial assistance, meals, mental health counselling, shelter, family violence support, and much more.

Ask Izzy is owned and operated by Infoxchange ABN 74 457 506 140. Third-party services are provided by parties other than H.E.S.T. Australia Ltd and under the terms and conditions of those parties. H.E.S.T. Australia Ltd does not recommend, endorse or accept any responsibility for the products and services offered by third parties or any liability for loss or damage incurred as a result of services provided by third parties. You should exercise your own judgment about the products and services being offered.

HESTA can take the guesswork out of retirement planning for you and your partner.

Former nurse and HESTA member Julie-Anne has been increasing her financial literacy through reading, online videos and super presentations. Read her story.