accessing your super

Super is your savings for your future, so there are some rules around when you can access it. Generally you need to wait until retirement, but you can access it sooner in limited circumstances.

accessing super at retirement

There's no set retirement age in Australia, so you can generally retire when you want to.

Your super is designed to help support you financially when you retire, so the government has set rules on when you can access it. These are called ‘preservation rules’.

Generally, you can access your super when you’ve met a condition of release, such as:

- when you’ve permanently retired or commence a transition to retirement income stream on or after preservation age which is now 60 years of age

- after reaching age 60, when an employment arrangement ceases

- when you reach age 65

- if you become permanently incapacitated

- if you have a terminal medical condition

- under financial hardship conditions.

Please refer to the ATO website for all other release scenarios.

Setting up a regular retirement income

If you’ve reached preservation age and/or meet a condition of release, you can access a regular income from your super while your money keeps working hard for you with a retirement income stream.

This is also called an account-based pension, and it’s a flexible way to access your super after you retire.

By starting a retirement income stream (eligibility criteria applies) using your super, you can receive a regular income (generally tax-free if you're over 60) while your balance stays invested.

More about HESTA Retirement Income Stream

Lump-sum withdrawals

You can access your super at retirement through a lump-sum withdrawal.

It's quick and easy to request a lump-sum withdrawal through your online account.

You first need to meet at least one of these conditions:

- you are age 65 or over

- you ceased an employment arrangement on or after age 60.

Haven’t reached preservation age?

Speak to a HESTA super specialist to work out how you can maximise your super before you reach preservation age. We can help you get the most out of your superannuation investments and talk through your options based on your personal circumstances.

You can book a time with them whenever you need. It’s all part of being with HESTA.

We’re here to help

You can visit our Retirement Hub for help with super and retirement planning relating to your HESTA account, so you’ll feel ready for your next chapter.

We can help you with:

- understanding what you need to get started

- super and the Age Pension

- access to personal advice.

Visit the Retirement Hub or make an appointment to chat with someone in our team at a time that suits you.

accessing super at preservation age

Still working? A HESTA Transition to Retirement (TTR) account allows limited access to your super before full retirement and can help you maintain your income, whilst reducing your hours at work.

To be eligible, you must have met your preservation age. Your preservation age is the age at which you can generally start accessing your super. This is now 60 years of age.

If you'd like to discuss opening a TTR account with us, you can make an appointment with someone in our team at time that suits you.

financial hardship

You might be eligible to claim some of your super.

Who can apply for financial hardship?

You can only make one withdrawal of up to $10,000 gross (which means before tax) in any 12-month period if:

- you’ve received eligible Commonwealth Government income support payments for at least 26 continuous weeks, and

- you are currently receiving these payments, and

- you can demonstrate you are unable to meet reasonable and immediate living expenses.

You can withdraw any amount if:

- you’ve reached your preservation age plus 39 weeks, and

- you’ve received eligible Commonwealth Government income support payments for at least 39 cumulative weeks since reaching your preservation age, and

- you are currently either unemployed, or you are employed for less than 10 hours a week.

Tax on financial hardship payments

The amount is paid and taxed as a lump sum. If you’re under age 60 this is generally taxed between 17% and 22%. If you’re aged over 60, the amount will be tax-free (excluding any untaxed elements). Learn more on the ATO website.

How to apply for financial hardship

Apply online

The fastest way to apply for a financial hardship payment is through your online account. Log in to your account and go to More actions > Access your super.

Log in to apply for financial hardship

Use the paper form

Read and complete the Financial hardship fact sheet and form (PDF) to apply, then return your completed form and other supporting documentation to us.

compassionate grounds

There are 'compassionate grounds' on which super can be released early. They are specified by the ATO and relate to medical treatment, funeral assistance, and palliative care.

Who can apply to access super on compassionate grounds?

To access your super under compassionate grounds, you’ll need to prove you’re unable to meet the expenses for one or more of the following:

- medical treatment and medical transport for you or a dependant (if you apply for compassionate release of super for medical treatment, the law states it must be necessary to treat a life-threatening illness or injury, alleviate acute or chronic pain, or alleviate acute or chronic mental illness)

- palliative care for you or a dependant

- a loan payment or council rates so you don't lose your home

- modifying your home or vehicle for you or a dependant because of a severe disability

- expenses associated with a death, funeral or burial of a dependant.

You can find the full set of conditions on the ATO website.

Tax on compassionate grounds payments

The amount is paid and taxed as a lump sum. If you’re under age 60 this is generally taxed between 17% and 22%. If you’re aged over 60, the amount will be tax-free (excluding any untaxed elements).

How to apply

The Australian Taxation Office (ATO) deals with the early release of super on compassionate grounds. The ATO determines the amount to be released from your super fund.

To apply, access the ATO application form, or visit ato.gov.au linked services in myGov. Alternatively call the ATO on 13 10 20.

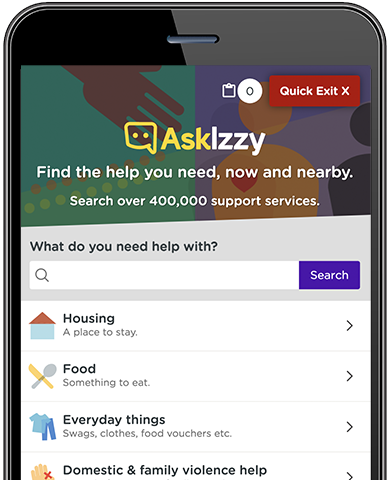

find support services outside of super

with Ask Izzy*

We’ve partnered with Infoxchange, the not-for-profit social enterprise behind Ask Izzy: a free directory that helps Australians find and access local support services.

If you need some help outside of super, the Ask Izzy website can connect you with nearby support services across Australia. You can search for over 450,000 services close to you, including financial assistance, meals, mental health counselling, shelter, family violence support, and much more.

*Ask Izzy is owned and operated by Infoxchange ABN 74 457 506 140.

Third-party services are provided by parties other than H.E.S.T. Australia Ltd and under the terms and conditions of those parties. H.E.S.T. Australia Ltd does not recommend, endorse or accept any responsibility for the products and services offered by third parties or any liability for loss or damage incurred as a result of services provided by third parties. You should exercise your own judgment about the products and services being offered.

first home super saver scheme

The First Home Super Saver (FHSS) scheme lets you save a first home deposit by making voluntary before or after-tax contributions to your super.

You can’t use contributions made to your super by anyone else — employers, government co-contributions, or a spouse — instead, you use the FHSS scheme to save your own contributions.

If you’re eligible for the FHSS scheme, you can use your super account to save up to $15,000 each financial year, up to $50,000 in total across multiple years.

Find out more about the FHSS scheme

temporary residents

If you've worked in Australia on a temporary resident visa, you can claim your super when you permanently leave the country — this is called a Departing Australia superannuation payment (DASP).

Find out more about DASP for temporary residents

More information on accessing your super

Visit the ATO website for all the ways you may be able to access your super.

We suggest you seek financial advice before accessing your super. That way, you can get the information you need to make the right financial decisions.