get to know your annual statement

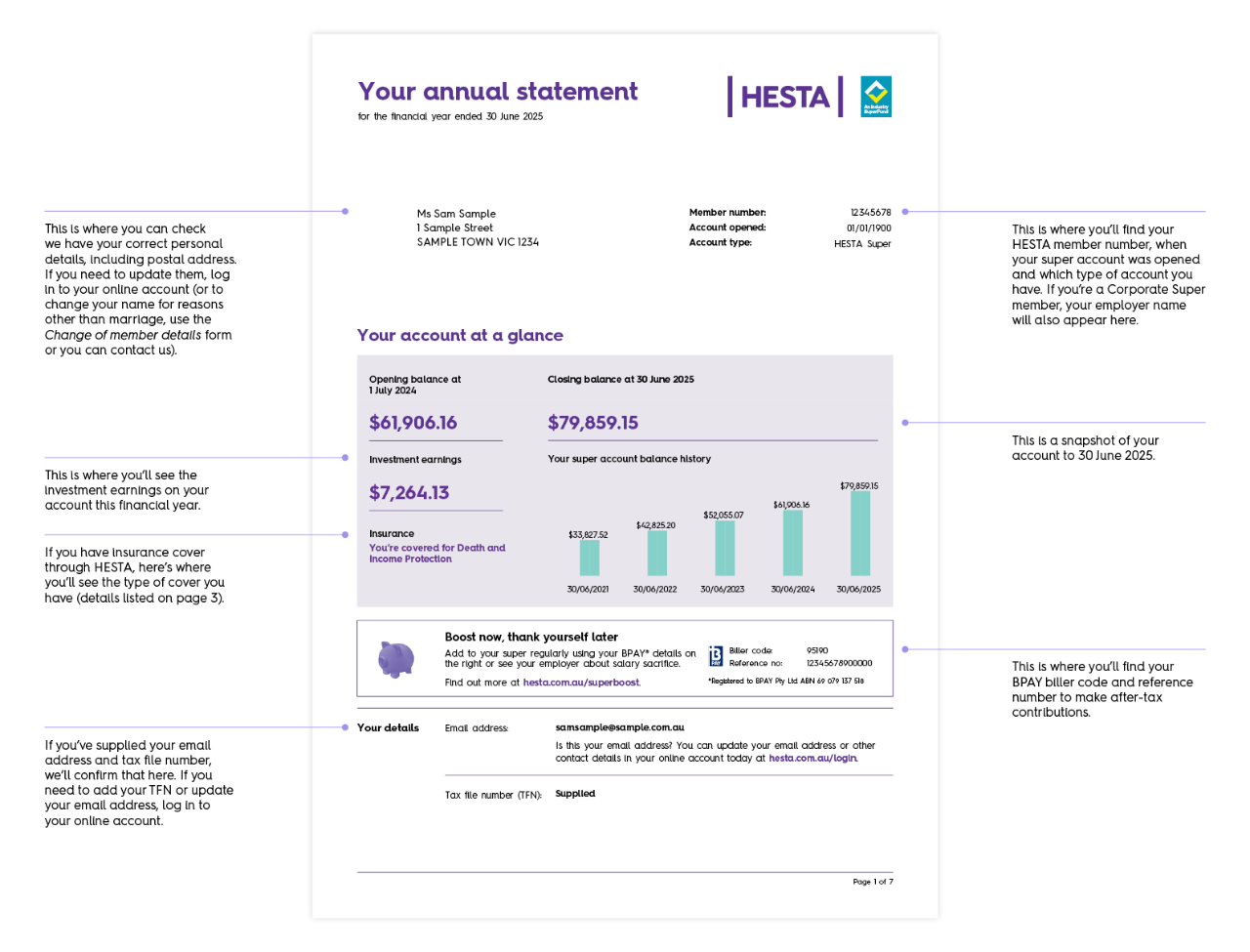

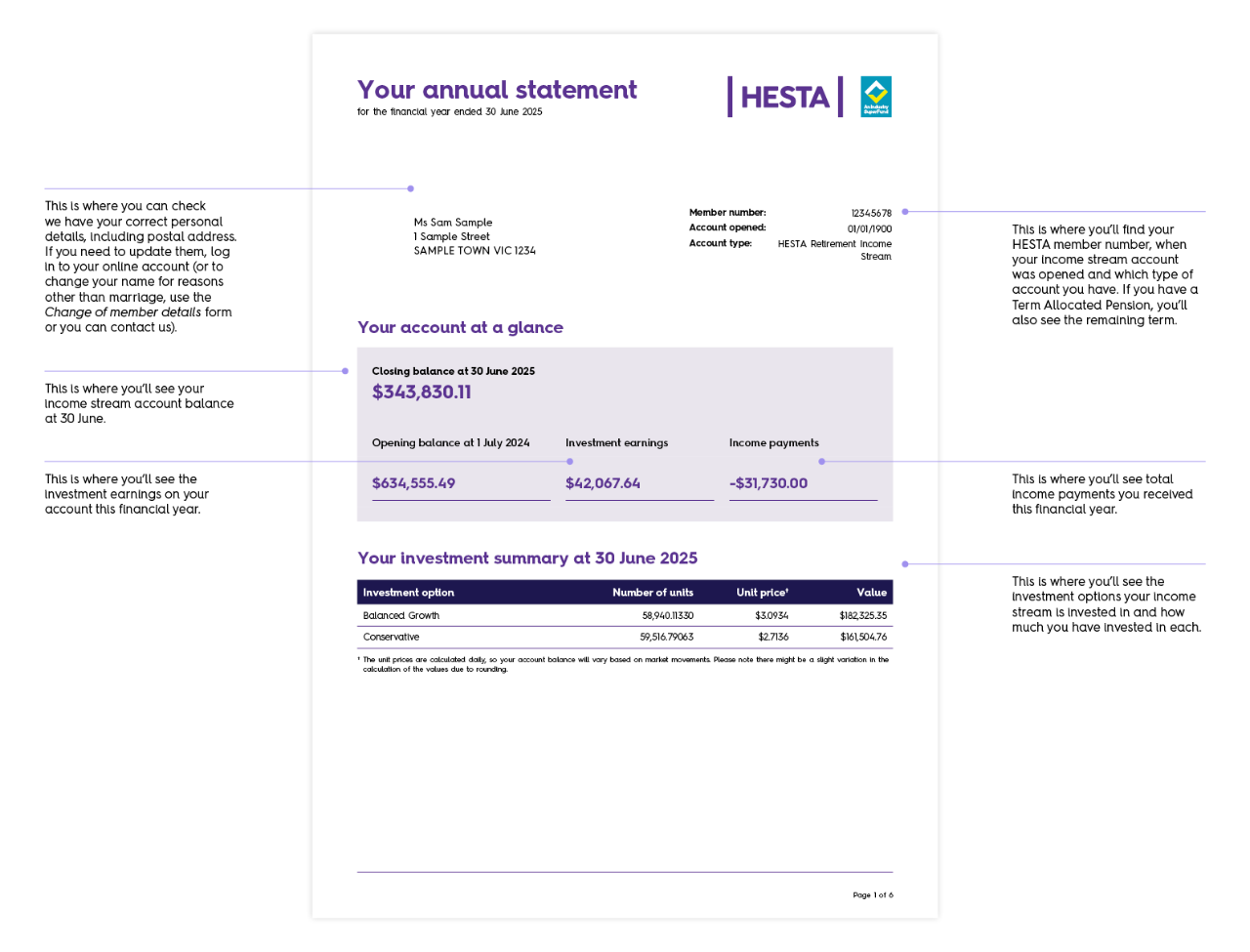

Each year, you receive a statement with details about your HESTA Super or Income Stream account as at 30 June.

Your annual statement is a great time to check in on your super. We’ll send you an email or letter to let you know when your statement is ready for you.

If you joined HESTA after 30 June, you’ll receive your first statement after the 2026 financial year ends — but you can check your account details anytime through your online account or the HESTA App.

how to access your statement

- You’ll get an email from us when your statement is ready, with a link to log in to your online account. (If you haven't set up online access yet, head to hesta.com.au/register to get started).

- If you've received your statement email, log in to your account and go to Transactions > Statements.

Post

If you’ve chosen to receive your member communications in hard copy, or we don’t have your email address, you’ll get your statement via post.

when you get your statement

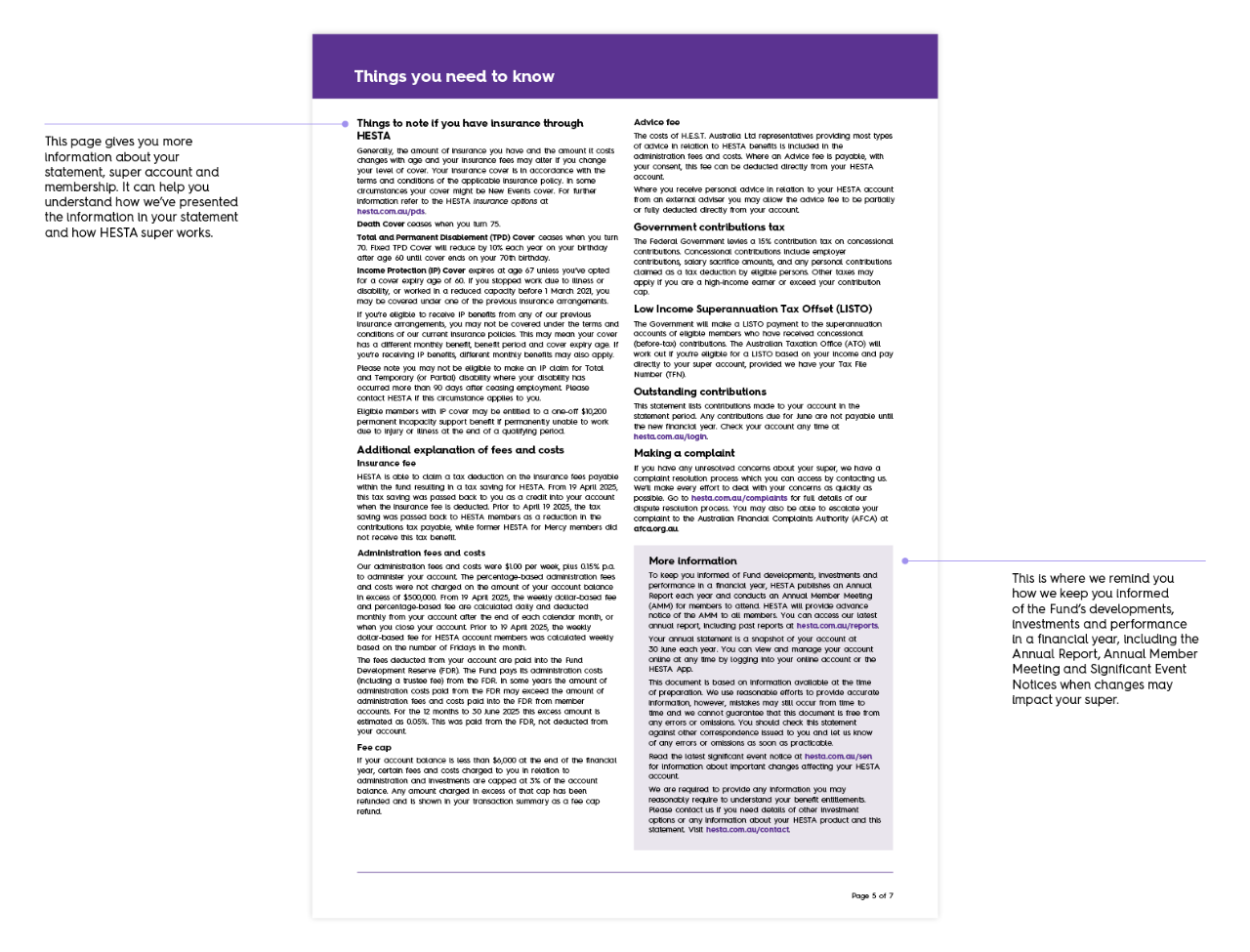

What’s inside

Every statement includes:

- your account balance and how it’s changed

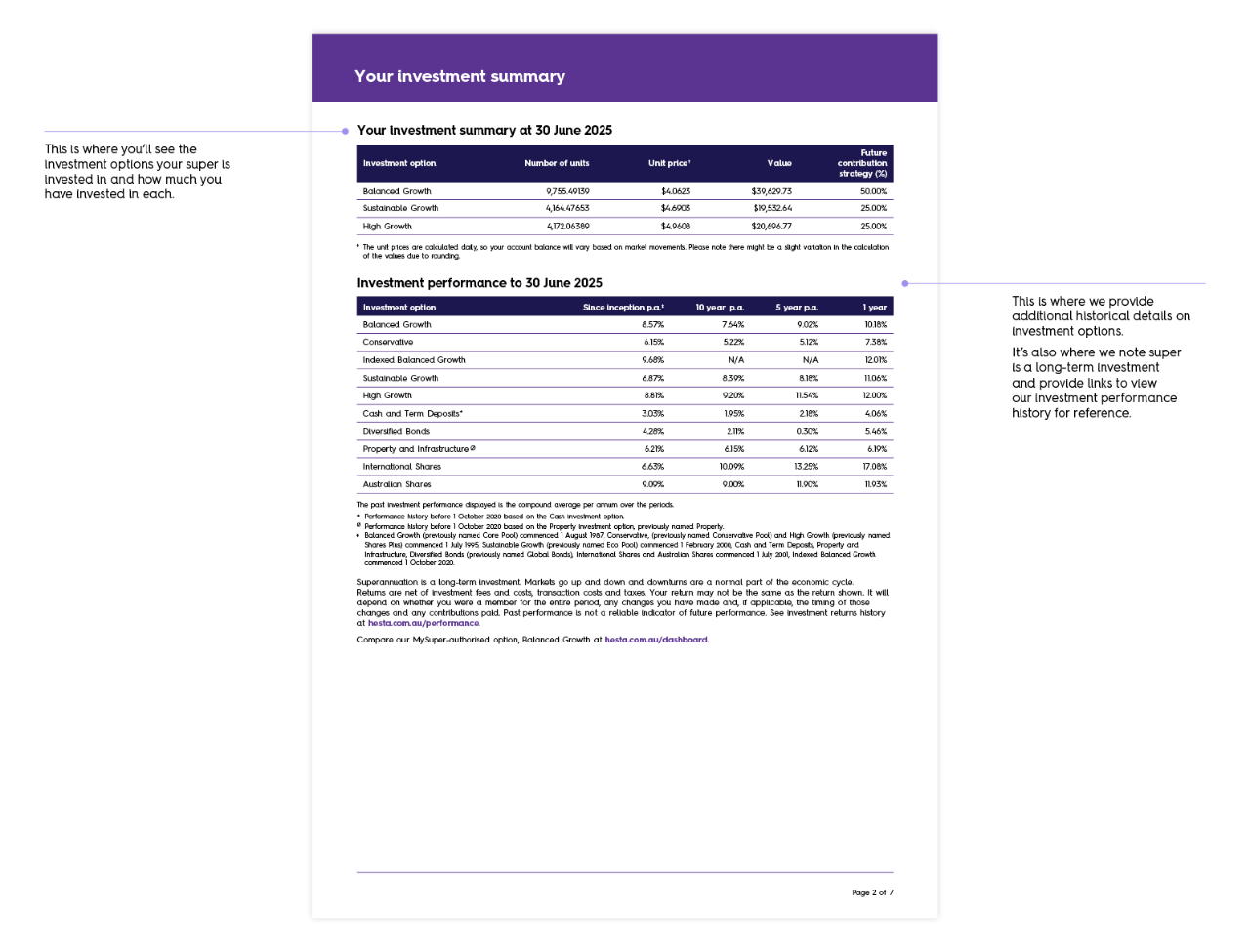

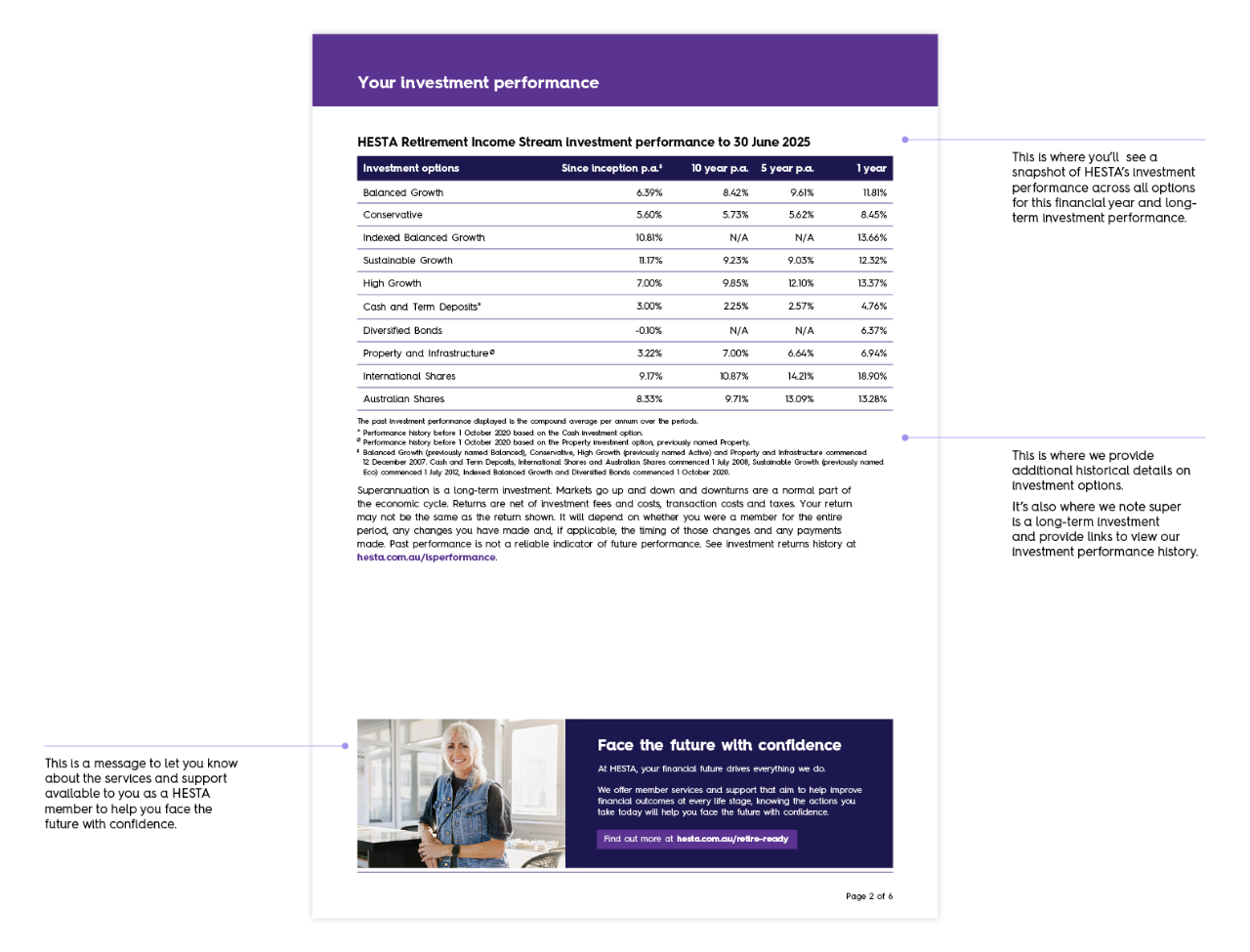

- your investments and investment performance

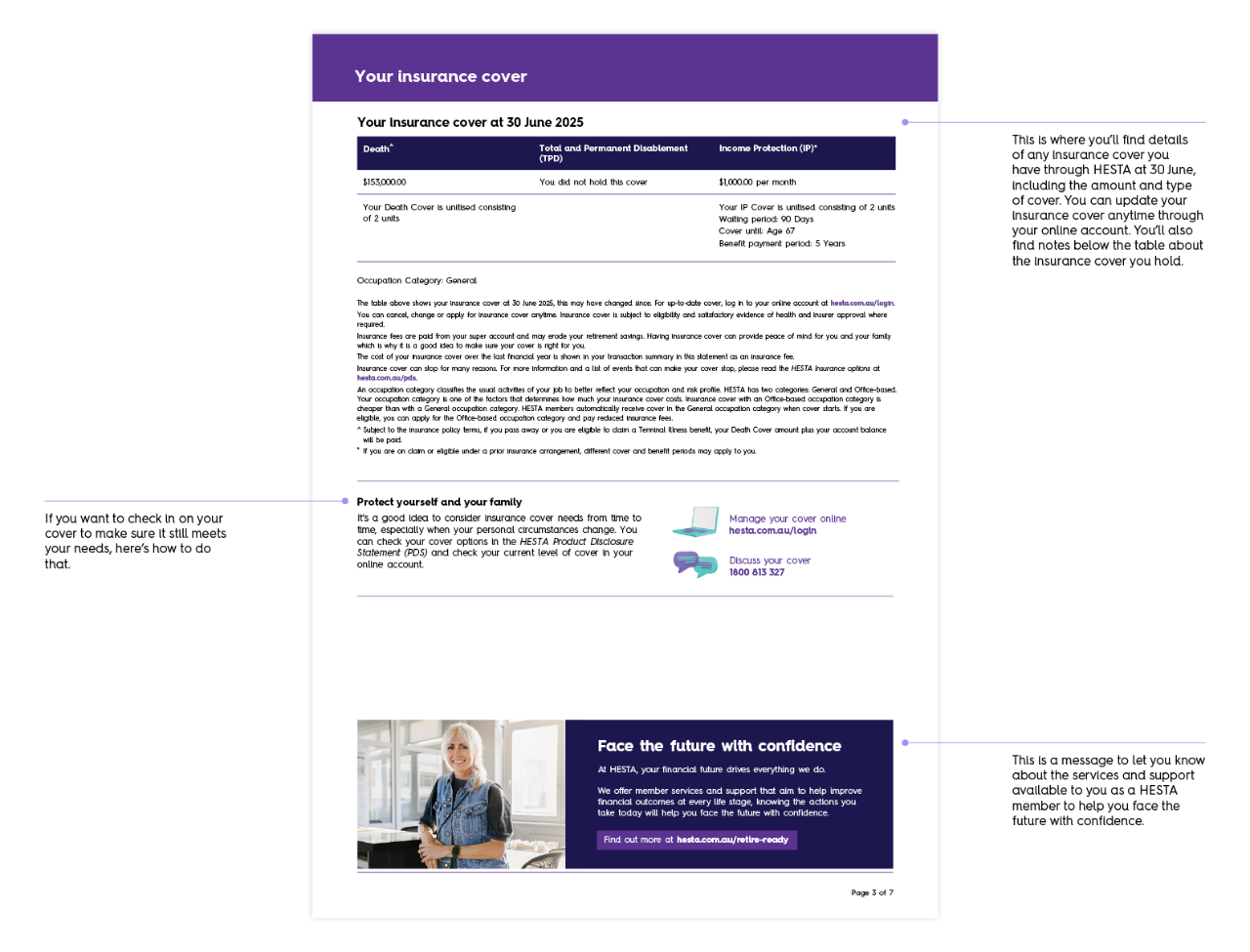

- your insurance cover (if applicable)

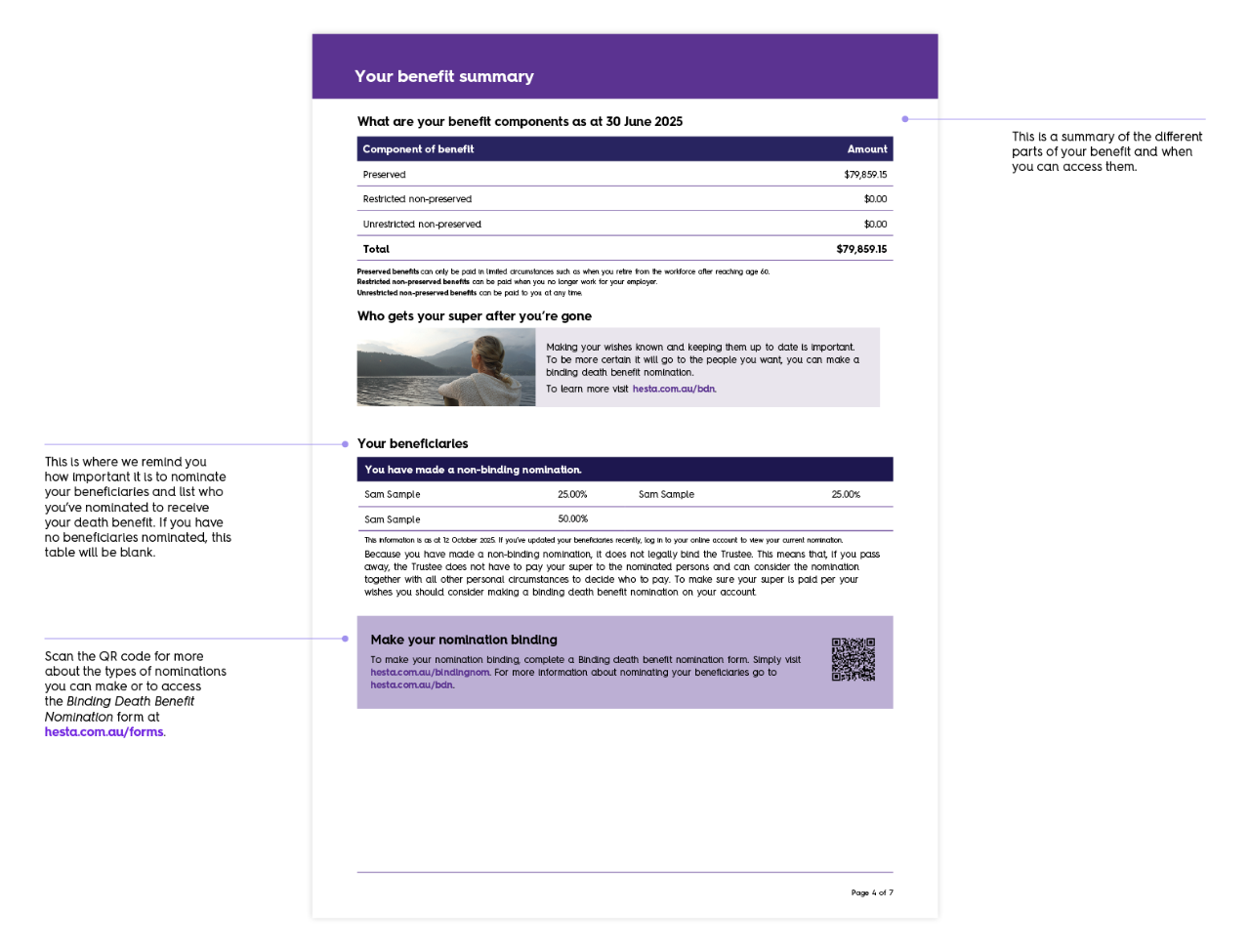

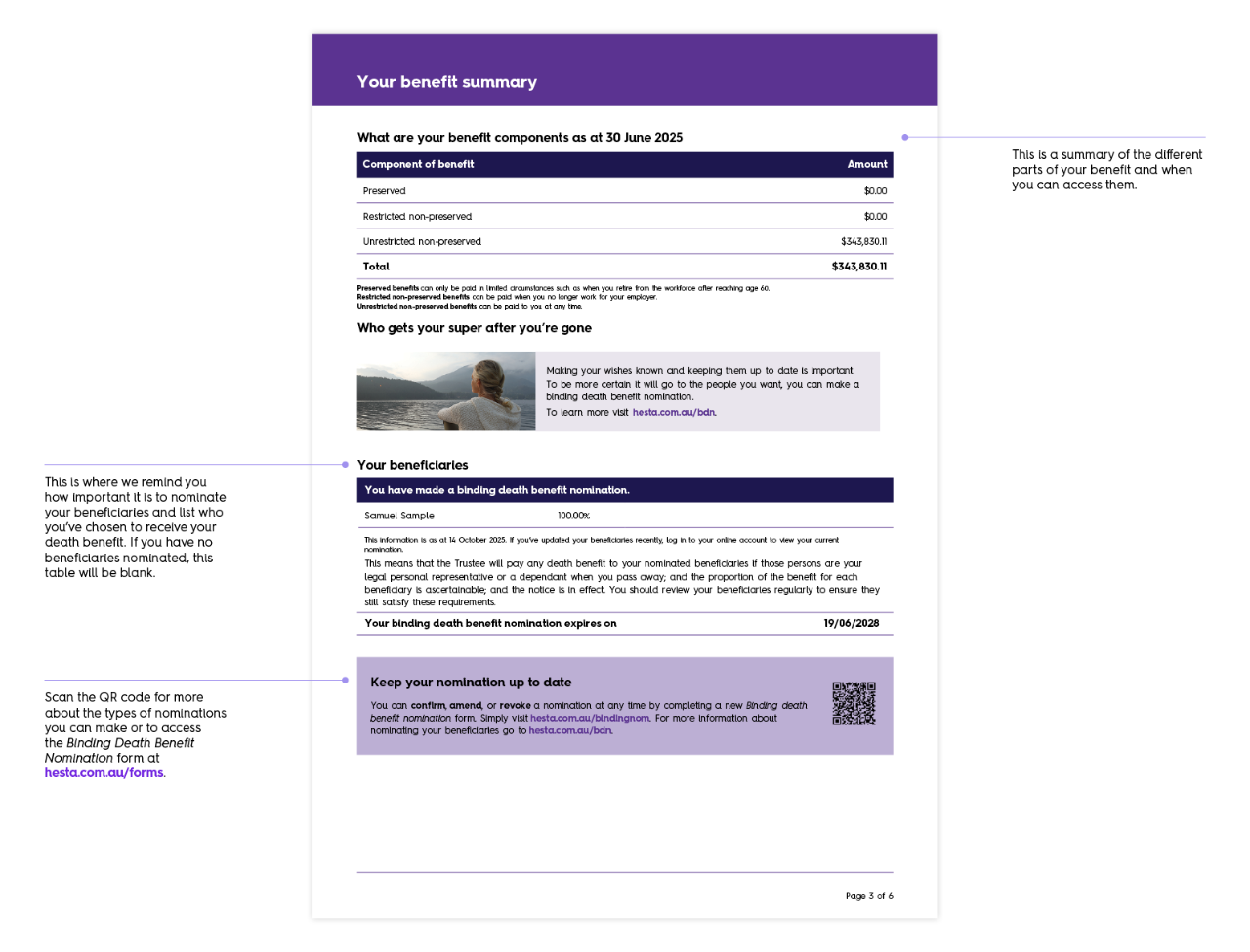

- your benefit components and nominated beneficiaries

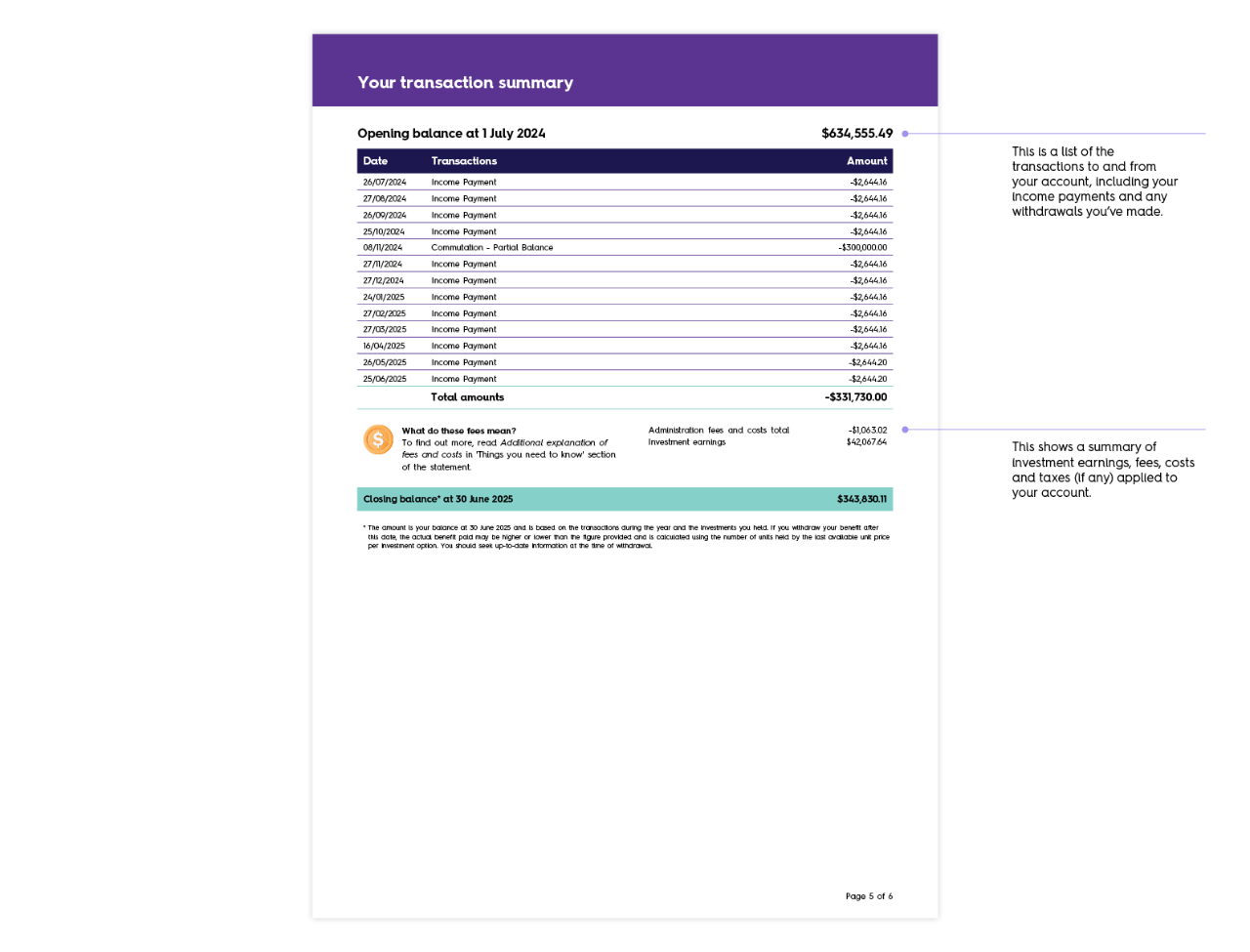

- contributions and transactions

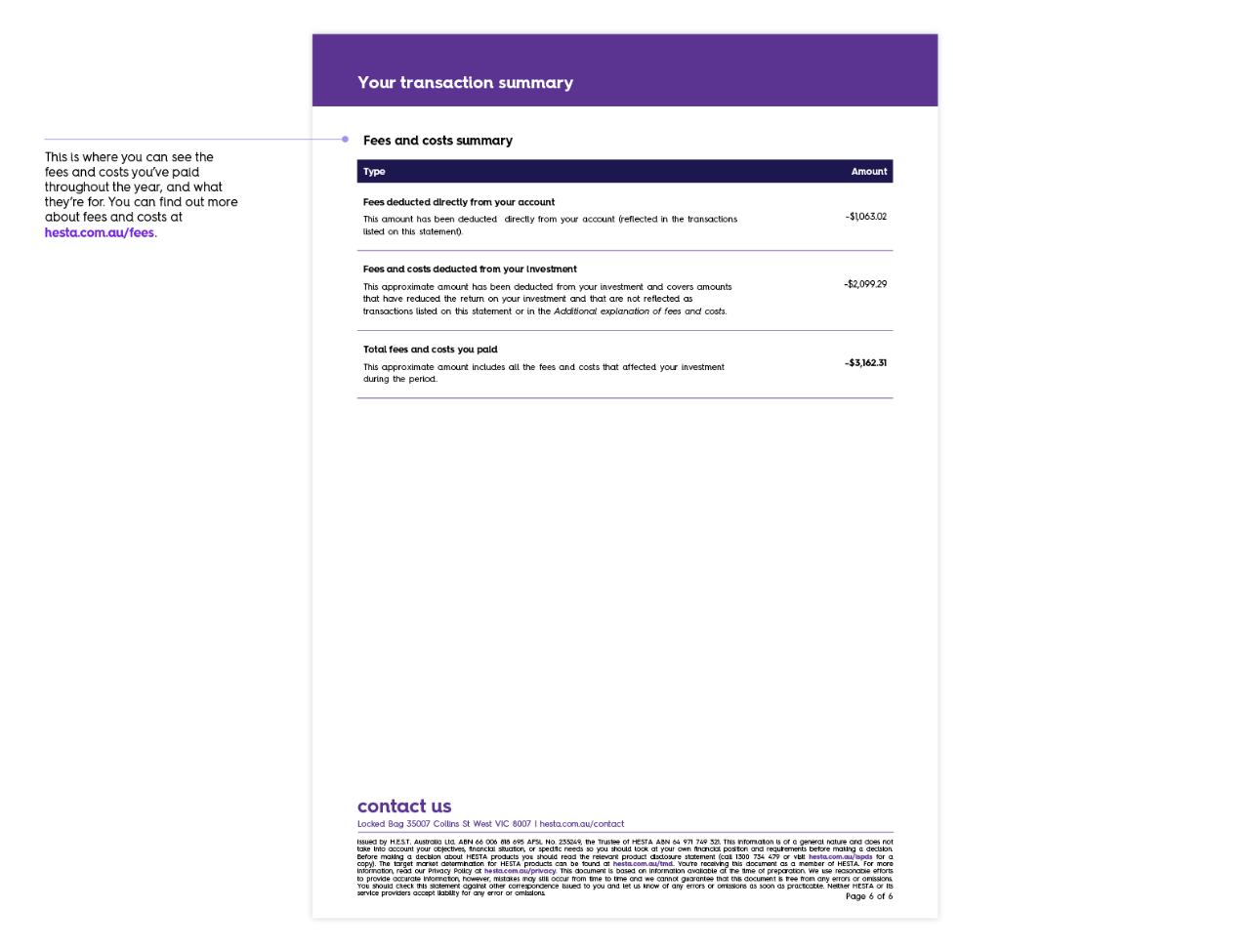

- fees and costs charged.

annual statement FAQs

Here are some common questions our members ask us about their annual statements.

Statements will be available in your online account and via post over the coming weeks. We send statements in waves over a few weeks to reach all our million members.

If you joined HESTA after 30 June 2025, you’ll receive your first statement after the 2026 financial year ends — but you can check your account details anytime in your online account.

If we have your email address, we’ll email you to let you know your statement is available to view in your online account. This is the quickest and easiest way to get your statement (and to check it anytime afterwards). Make sure you've set up your account access (if you haven't, head to hesta.com.au/register and have your member number ready).

If you’ve told us you’d prefer to receive your member communications by post, or we don’t have your email address, you’ll receive your statement in the mail.

Log in to your account and go to Transactions > Statements.

Your income payment summary isn’t in your statement: instead, log in to your online account anytime to see it (click on the Payments tab).

You’ll also have received it directly from us earlier this year (if you started your HESTA income stream before 30 June 2025).

Contact us if you have any problems finding your payment summary.

Here are some quick troubleshooting tips.

- Make sure you’ve registered for your online account

It’s the quickest and easiest way to manage your super. Set it up now at hesta.com.au/register

- Make sure you’re using the correct ‘Username’

This will be the member number you used to set up your online account. For most people it’s your current member number, but if you have more than one account, it will be the member number of the first account you opened with us. If you can’t find your original member number, contact us.

- If you need to reset your password

First, double check you’ve registered and entered your member number correctly. Your member number will be on the email we sent you. If you do need to reset your password, we’ll send a reset link to the email address we have on file for you. If you don’t receive it within a few minutes of trying, check your junk/spam folder. If it’s not there, contact us as we might need to update your email address.

- Logging in, but not receiving your verification code?

Verification codes go to the mobile number we have on file for you. If you’re not receiving it, we may not have your current mobile number. Contact us to check and update it if needed.

No, you don’t need your annual statement to complete your tax return. That’s because:

- insurance through super isn’t tax deductible. While the ATO allows you to claim the costs of income protection cover outside of super, your cover through your super can’t be claimed

- for most members, your super contributions aren’t tax deductible either (unless you’re making extra after-tax super contributions into your account – see How do I claim a tax deduction on my personal (after-tax) super contributions?). You don’t need to have the total amount of contributions for the year to complete your tax return.

You can view your statements for the past 5 years anytime in your online account under Transactions. You can also contact us for printed copies.

You don’t need your annual statement to do your tax return, but you may choose to keep a copy for your own records.

Log in to your online account to see 5 years’ worth of statements under Transactions. You can also contact us for printed copies.

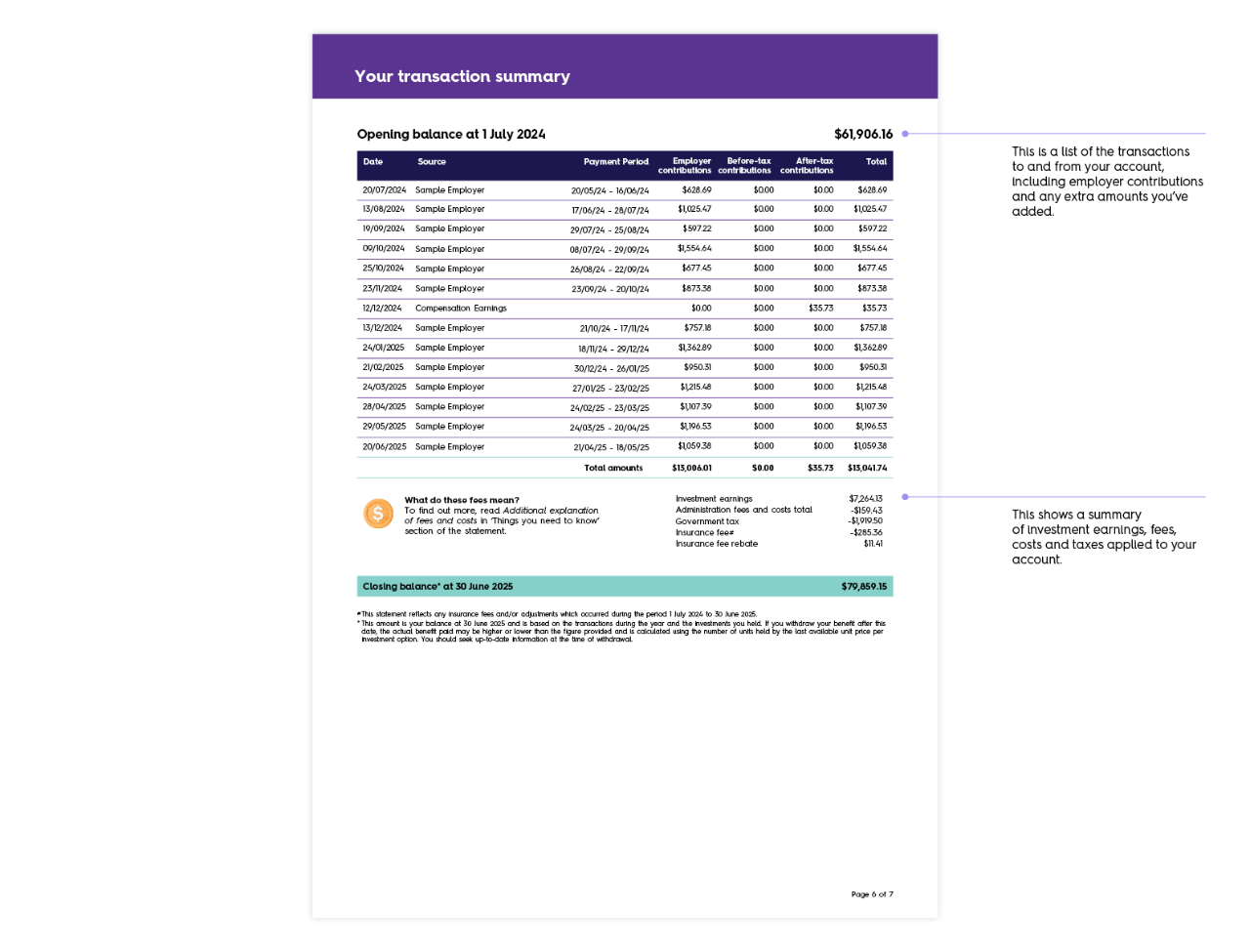

Your statement includes ‘Your transaction summary’ where you’ll find a detailed transaction summary, including your annual super contributions. You can also log in to your online account to view all your transactions as at the current date.

If you left HESTA before 30 June, you won’t get an annual statement for the financial year — instead, you will have received an exit statement with your final transaction details. If you need a copy of your exit statement, contact us.

Statements are only produced in English, but you can get help in your language.

The government applies a 15% contributions tax on concessional contributions, including employer contributions, salary sacrifice (before tax), and any after-tax contributions claimed as a tax deduction. Other taxes may apply if you are a high-income earner or exceed your contribution cap.

You may be eligible to claim a tax deduction for after-tax super contributions by lodging a notice of intent to claim with the ATO. Find out how in Claiming a tax deduction on your super contributions.

- Income Protection (IP) Cover: provides a monthly benefit to help you and your family meet ongoing living expenses, if you are sick or injured and cannot work.

- Death Cover: provides a lump-sum benefit to help with ongoing expenses and one-off costs your family may face if you die or in some cases, become terminally ill.

- Total and Permanent Disablement (TPD) Cover: provides a lump-sum benefit to help you and your family meet ongoing and one-off costs, if you become totally and permanently disabled and unlikely ever to be able to return to work.

Find out more about insurance through HESTA at Insurance options.

You’ll see your net investment earnings on page 1 and in the 'Transaction summary' in your statement. You can also see your investment performance anytime in your online account.

The value of your investments rises and falls over time with changes in investment markets. While it can be uncomfortable to watch, it’s important to remember that super is a long-term investment.

Find out more about how this works and steps you can take to feel prepared in Market changes and your super.

You can find your key super information in your online account, including:

- your investment earnings

- what investment option(s) your super is invested in

- the contributions or payments you’ve received

- your insurance cover (if applicable)

- your personal details and preferences.

If you don’t already have an online account, it’s easy to set one up. Just have your member number ready and visit hesta.com.au/register. We’ll take you through the next steps to get your online account up and running. It only takes a minute or two.

You can switch investment options anytime. The quickest and easiest way to switch investment options is through your online account.

Log in to your account and go to Investments.

Before switching investments, take a look at the Risk Profiler to help you decide whether that’s right for you, and seek advice if you’re not sure.

more questions about your statement?

This information is of a general nature. It does not take into account your objectives, financial situation or specific needs so you should look at your own financial position and requirements before making a decision. You may wish to consult an adviser when doing this.