Our diversified approach

HESTA is committed to helping our members achieve strong, long-term investment outcomes — a key part of this commitment is our diversified investment approach.

Debby Blakey: Hello, I’m Debby Blakey, CEO of HESTA.

Firstly, I want to thank you for being a valued member.

And as the 2024-25 financial year wraps up, we’re pleased to share our investment results.

Over the past year, the market experienced significant ups and downs.

While we understand this can feel uncomfortable in the moment, it demonstrates the importance of keeping a long-term perspective.

Our investment team, led by Sonya Sawtell-Rickson, remains focused on capitalising on opportunities in these times.

Please know we’re committed to helping you face the future with confidence and HESTA is well-placed to manage your super.

We are incredibly proud of our history of delivering strong, long-term returns to members.

On that note, I’ll hand over to Sonya who will share our results.

Sonya Sawtell-Rickson: Thanks Debby.

Hi, I’m Sonya Sawtell-Rickson, the Chief Investment Officer at HESTA.

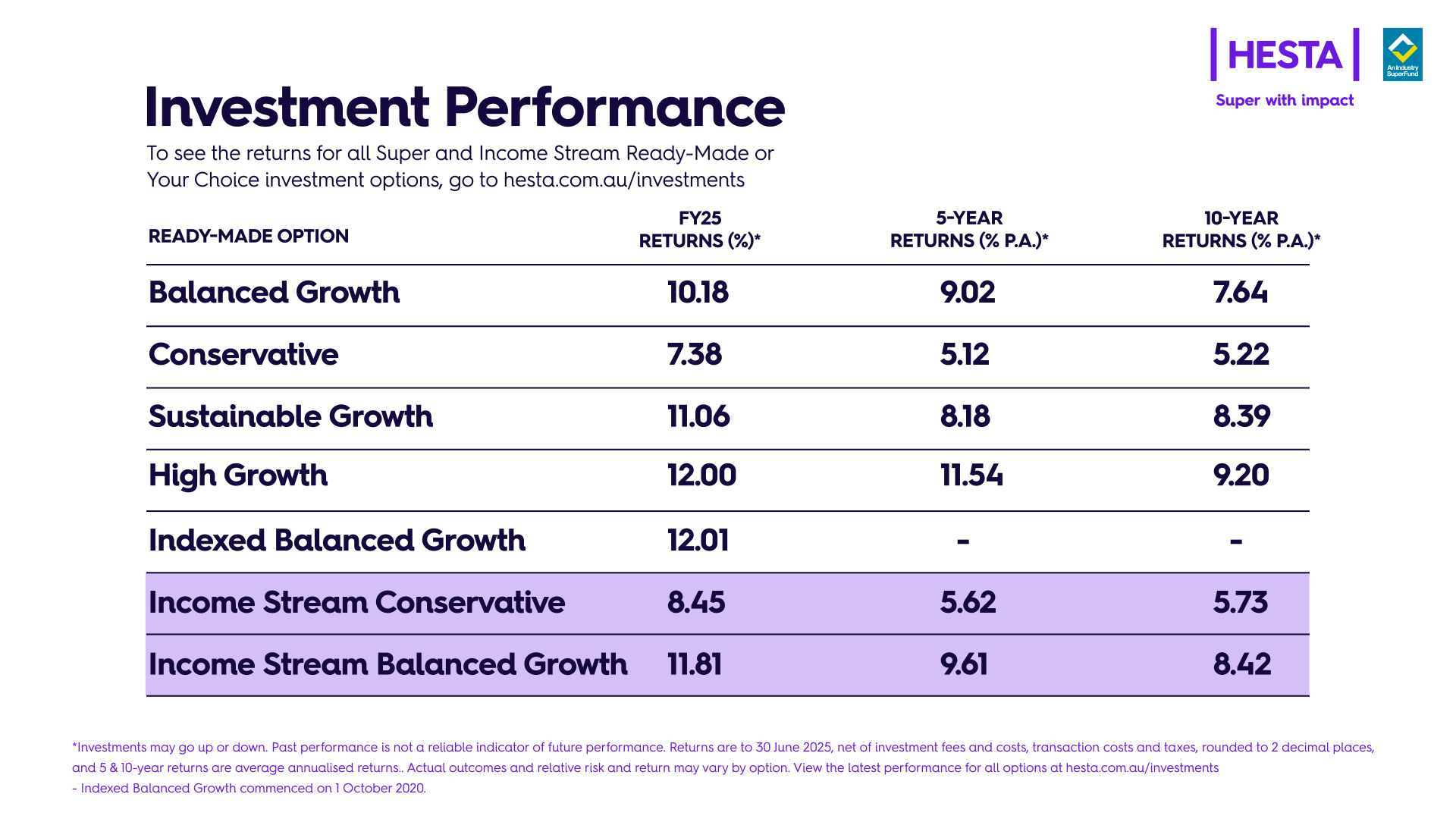

I’m pleased to announce that it has been another strong year, and our default MySuper Balanced Growth option – where most HESTA super members are invested - achieved a double-digit return of 10.18% for the 2025 financial year, bringing the 5 year return to over 9% p.a.

Balanced Growth has exceeded its 10-year investment objective, delivering 7.64% p.a. over this period - a strong overall result for members in our default option.

Our High Growth option achieved a stellar result of 12% for the year, bringing its 5-year performance to 11.54% p.a., while our Conservative option delivered 7.38% for the year and 5.12% p.a. over 5 years.

On the screen, you can see the returns for our Ready-Made options for HESTA Super members, along with the options that form part of our HESTA Income Stream default strategy.

Despite these strong results, it wasn’t all smooth sailing this year as geopolitics, technology and central banks took centre stage.

After the US elections, share markets pushed to historic highs, led by technology and enthusiasm about Trump’s pro-business agenda.

In the second half, The Trump Administration’s significant tariff announcements then triggered market volatility and led to drawdowns in share markets around the world.

However, as probable tariff outcomes became clearer, we saw a repricing of the risks and a strong recovery. This led to double-digit returns in many global share markets, with the ASX200 gaining 13.8% and the US S&P 500 up 15.2% over the financial period.

The other pleasing development over the year was the ongoing moderation of inflation. This allowed central banks to initiate interest rates cuts, supporting the economy and bonds but reducing the return from cash investments.

Looking ahead, we expect themes like geopolitics, climate change and artificial intelligence to continue to be key thematics in markets and these will remain a focus over the year ahead.

We’re proud to have delivered strong absolute performance for our members this year, but we know it is the long term that matters … which is why we are most proud that all of HESTA’s Ready-Made super options have outperformed their 10-year investment objectives and remain in the top quartile of their SuperRatings peer groups over the 10 years to 30 June 2025.

On behalf of the investment team - thank you for choosing HESTA.

For Super and Transition to Retirement (TTR) members, our Balanced Growth option returned 10.18% over the 12 months to 30 June 20252.

You can view all our returns on our Super and Transition to retirement performance page.

1 Except Indexed Balanced Growth, which only commenced on 1 October 2020 and has returned 9.68% average annualised return since inception.

2 Investments may go up or down. Past performance is not a reliable indicator of future performance. Returns are net of investment fees and costs, transaction costs and taxes.

For Retirement Income Stream (RIS) members, our Balanced Growth option returned 11.81% over the 12 months to 30 June 2025, and our Conservative option returned 8.45% over the same period2.

You can view all our returns on our Income Stream performance page.

Balanced Growth is the default option for HESTA Super, while a blend of Balanced Growth and Conservative is the default strategy for the HESTA Income Stream.

2 Investments may go up or down. Past performance is not a reliable indicator of future performance. Returns are net of investment fees and costs, transaction costs and taxes.

Responsible Investment is a global movement, and it’s important to see how we stack up against leading investors from around the world. The RAAI provides a benchmark of excellence among asset allocators, enables knowledge-sharing among peers, and helps set a policy agenda and advocacy program to mobilize more capital into responsible investments. This year, HESTA again placed in the top quintile of 250 funds globally, and we continue to engage and improve on our Responsible Investment practice.

In May 2025, HESTA won the Chant West Specialist Fund of the Year award. Chant West is a research firm that reviews over 300 superannuation funds yearly to provide ratings and awards, which recognise excellence across a range of key criteria, such as investments, member services, fees, and insurance. Alongside our consistent 5 Apples rating, this award recognises our outstanding performance and dedication to delivering exceptional value for our members in the health and community services sector.*

Finally, we are thrilled to highlight an investment that exemplifies HESTA’s long-term Total Portfolio Approach thinking, while helping us to deliver on our vision for Super with impactTM.2

HESTA is proud to be a long-term investor in EBR Systems. EBR Systems has gone from strength to strength recently with its WiSE CRT System, receiving FDA approval in April 2025, followed by the first commercial implants in June 2025, significant milestones towards commercialisation.

Around 64 million people globally live with heart failure, and while treatments exist, not all patients respond to them. For those who don’t, the options can feel limited and the future uncertain. That’s where EBR Systems’ technology offers something new.

So what does that mean in real life? It means being able to walk up the steps of the MCG to watch the footy, play with grandkids in the backyard, or simply breathe easier while making a cup of tea. It’s not just about extending life, it’s about restoring the parts of life that matter most.

We were an early investor in the company and its revolutionary technology, and our holding embodies our Total Portfolio Approach to investment.

The opportunity arose from our close partnership with one of our external investment managers, Brandon Capital, and is the result of the close collaboration between our Unlisted Assets and Direct Equity teams.

In identifying promising companies and technologies, our commitment to investment excellence with impact encourages Australian innovation while supporting long-term member returns. Learn more about EBR System’s work.

1 Except Indexed Balanced Growth, which only commenced on 1 October 2020 and has returned 9.68% average annualised return since inception.

2 Investments may go up or down. Past performance is not a reliable indicator of future performance. Returns are net of investment fees and costs, transaction costs and taxes.

3 Zenith CW Pty Ltd ABN 20 639 121 403 AFSL 226872/AFS Rep No. 1280401 Chant West Awards issued 21 May 2025 are solely statements of opinion and not a recommendation in relation to making any investment decisions. Awards are current for 12 months and subject to change at any time. Awards for previous years are for historical purposes only. Full details on Chant West Awards at https://www.chantwest.com.au/fund-awards/about-the-awards/

* The Zenith CW Pty Ltd ABN 20 639 121 403 AFSL 226872/AFS Rep No. 1280401 Chant West rating (assigned February 2025) is limited to General Advice only and has been prepared without considering your objectives or financial situation, including target markets where applicable. The rating is not a recommendation to purchase, sell or hold any product and is subject to change at any time without notice. You should seek independent advice and consider the PDS or offer document before making any investment decisions. Ratings have been assigned based on third party data. Liability is not accepted, whether direct or indirect, from use of the rating. Past performance is not an indication of future performance. Refer to www.chantwest.com.au for full ratings information and our FSG. Chant West Awards issued 21 May 2025 are solely statements of opinion and not a recommendation in relation to making any investment decisions. Awards are current for 12 months and subject to change at any time. Awards for previous years are for historical purposes only. Full details on Chant West Awards at https://www.chantwest.com.au/fund-awards/about-the-awards/

HESTA is committed to helping our members achieve strong, long-term investment outcomes — a key part of this commitment is our diversified investment approach.

Read our 2025 performance and market recap, and our deep dive on diversification.

We use our expertise and influence to deliver strong long-term returns while accelerating our contribution to a more sustainable world.