Reduce your working hours

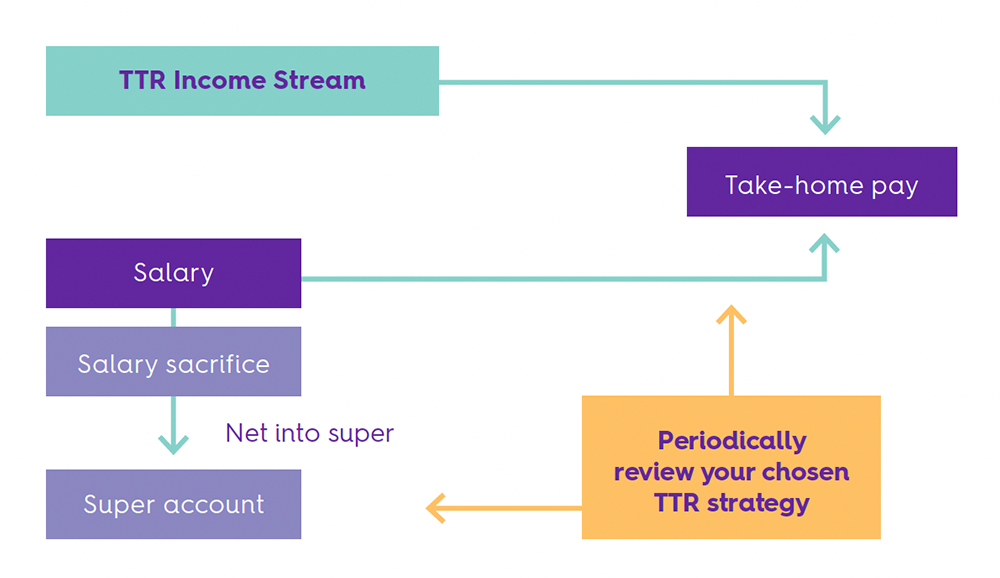

Want to cut back a bit on work? You could set up a transition to retirement (TTR) income stream to pay you some income from your super while you keep adding to your retirement savings. Depending on your personal situation, you could even end up with the same after-tax income as you enjoyed when working full time — with fewer work hours.

Boost super before you retire

A TTR income stream can help you boost your super balance for when you eventually retire. It lets you restructure the way you receive your income, so your take-home pay stays the same while boosting your retirement savings.