how much will I need in retirement?

There's no one-size-fits-all magic number that you need to save. It all depends on the lifestyle you want.

watch the video:

how much super do I need in retirement?

Linda Panaszek, HESTA Superannuation Specialist:

The first question members ask when they think about retirement is when can I get my money?

Although the answer is relatively straightforward, when you meet a condition of release, it's possibly more important to understand how long your super will last.

Remember, once your super balance is gone, the maximum age pension income sits below the poverty line.

So the better question to answer is have I got enough in super and will it run out?

A study from the RMIT University found that of those soon to be retired, 60% worry about running out of money while 73% don't know how much they will have in retirement.

The comfort our members get from understanding their own situation and gaining control of it is their light bulb moment.

It might be that they need to save a little bit more or be pleasantly surprised that from here their retirement will be fine, or maybe that from here anything more saved will be a bonus.

How much do we need in retirement?

Everyone's financial situation is different.

First, you need to figure out how much you're likely to spend each year.

Getting closer to retirement may mean you have a better understanding of what your annual budget might look like.

Fine tuning this starts to put the picture into focus.

If you're not sure what that looks like, jump onto your member only Future Planner.

Just log into your online account to get started.

Future Planner uses estimates based on what current retirees are spending to help you get a sense of what you might need.

Use those estimates or your own to test out different scenarios.

Second, think about how many years you might need your regular income to last.

This is never an exact science.

Knowing when you plan to retire can help with a start date, but to know the end date, you'd need a crystal ball.

So instead we use the average life expectancy.

Future Planner allows you to play with the date you retire so that you can see how this effects how long your super could last.

Income from super and other assets might provide your income needs in retirement.

Most will use their super or other assets to supplement their income.

Future Planner is a great way to step through this calculation.

It will ask you questions that will help you personalise the outcome and understand what can be done to bridge the gap between what you need and what you are currently projected to have, if there is one.

Now you know the basics, but as we've mentioned, there are a few variables which make calculating how much you need very personal.

A quick chat can make sure you're on the right track.

Jump on to a live chat or call our retirement hub to work through what you're aiming for and how you can reach your retirement goal.

retirement income and the Age Pension

Most people will use a mix of their super and the Age Pension for their retirement income. Understanding how they work together can help you know how much super you'll need to live the life you want.

One study estimates a single person needs around $54,840 per year to live comfortably, and a couple about $77,375.^

With the Government Age Pension for 2025-26 only paying around $30,646* a year for singles, there's clearly a gap between what you'll get from the Age Pension and what you need to live comfortably.

This is where your retirement savings in superannuation come in to help — topping up your income from the Age Pension.

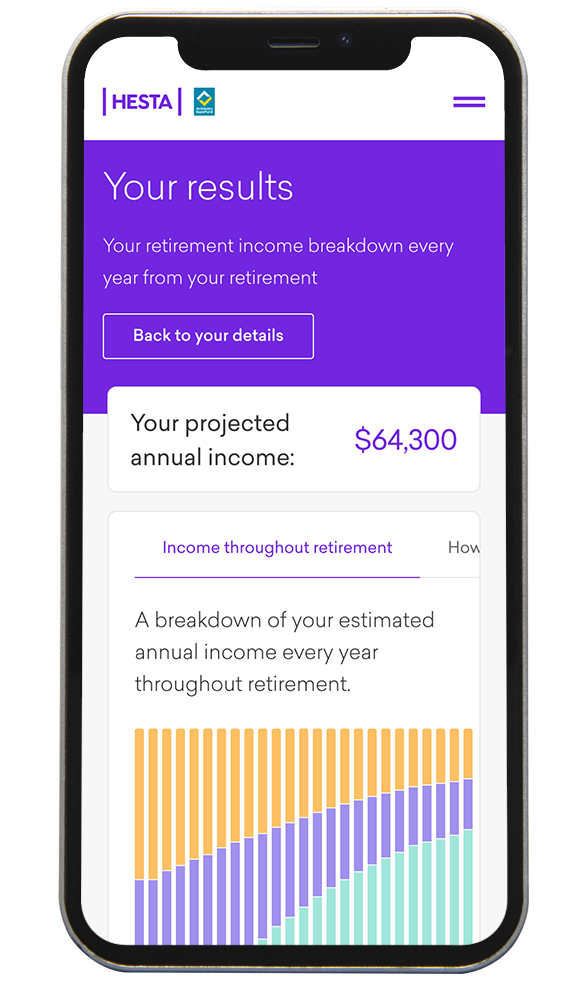

see how much you're projected to have

in retirement

Our Future Planner tool can help you:

- see how much money you're projected to have in retirement

- see how your projected annual household income compares to the Association of Superannuation Funds of Australia (ASFA) comfortable retirement standard; and

- explore options to grow your super.

For illustrative purposes only.

other things you need to consider

![]()

1. How much do I need to budget for?

Figure out how much you're likely to spend each year. Getting closer to retirement may mean you have a better understanding of what your annual budget might look like. Think about what you'll need for housing, transport, healthcare, insurance, debts, food, travel, and entertainment.

Use MoneySmart's Budget planner >

![]()

2. How many years will it last me? Use Future Planner to work it out

Consider how long your income in retirement needs to last. Knowing when you plan to retire can help with a start date, but without a crystal ball for the end date, we use the average life expectancy. Try different scenarios in Future Planner to see how long your super could last and what your retirement might look like.

![]()

3. Income from super and other assets

On top of super, you might also have other sources of income to consider: an Age Pension from the government, earnings from shares or other investments, and any other money from other assets. Most people use their super or assets as an income that supplements their income from the Government Age Pension (if they're eligible and can get it). Together, everything adds up to fund what you'll need for retirement, so think about the full picture and spend some time working out what position you'll be in overall.

See how income layering could work for you >

![]()

4. Looking for more support?

If you're worried, confused or just too busy to spend time on this, HESTA super experts can help you through it all. We know that budgeting and calculating income can be quite personal, so a quick chat with us can help make sure you're on the right track.

Book a 30-min call with a super expert >

grow your super before retirement

Need help to work out how much you may need?

Our HESTA super experts can walk you through it.

* Figure includes the maximum pension and Clean Energy Supplements, Services Australia, October 2025.

^ Association of Super Funds Australia Retirement Standard, December 2025.