grow your super before retirement

Growing your super now while you're still earning a regular income can help fund all the things you're looking forward to in retirement, and help you retire with confidence.

want to retire with more super?

Check what goes in, what comes out, and what it earns.

![]()

Consider extra contributions to boost what goes in

Are your retirement savings just from the super your employer pays? If you put some of your own money into your super as well, it could give your super balance a bigger boost.

![]()

Combine your super to reduce what goes out

If your super is in different funds, multiple account fees are coming out. But if you combine all your super into one account, you'll reduce your fees so more stays in your retirement savings.

![]()

Review your investment options and see how they're performing

The investment options you choose can have a big impact on what you end up with in retirement. It’s a good idea to review your investments regularly to make sure they're right for you.

the magic of time and compounding

Compounding is like a snowball effect for your money — as it rolls, it gets bigger and bigger, and the earlier you start, the more time compounding has to work its magic on your super balance.

How compounding works

Compound interest is all about letting your money grow over time by allowing what you earn to keep growing, instead of spending it.

Here’s how it generally works:

- Principal: this is the money you originally invest

- Simple interest: this is what you earn over a time period on the principal

- Compound interest: instead of spending the simple interest, you leave it there to grow. This means you’re earning interest on the interest.

This cycle keeps repeating, and over time, your money grows faster and faster. This is known as compounding.

Let's look at an example

See the impact compounding has over the long term. Starting balance (also known as principal) of $10,000 earns 10% interest, compounded annually.

| Year | Simple interest earned (10% p.a.) |

Compound interest earned (10% p.a.) |

|---|---|---|

| 1 | $1,000 | $1,000 |

| 2 | $2,000 | $2,100 |

| 5 | $5,000 | $6,105 |

| 10 | $10,000 | $15,937 |

| 15 | $15,000 | $31,772 |

| 20 | $20,000 | $57,275 |

| 30 | $30,000 | $164,494 |

| How many times original? |

3x | 16x |

Starting balance and interest rate simplified for illustrative purposes.

No additional amounts added or deducted, other than interest.

Numbers are nominal and rounded to the nearest whole number.

Not to be compared with superannuation returns.

other smart ways to boost your super balance before retirement

I've heard about salary sacrificing, but how does it work and why do it? Could it help me pay less tax?

See how salary sacrifice works >

What about after-tax contributions? And could I get a $500 co-contribution from the government?

After-tax super contributions >

What if I downsize my home? See if and when you can make a downsizer contribution to super, and what the benefits could be.

In a relationship? One of you not working? Spouse contributions could set you both up for retirement.

Before-tax super can also be split between partners, as another way to boost balances. This is known as contribution splitting.

See how contribution splitting works >

When it comes to making contributions to super, are there any rules and amount limits?

ready to start planning your future?

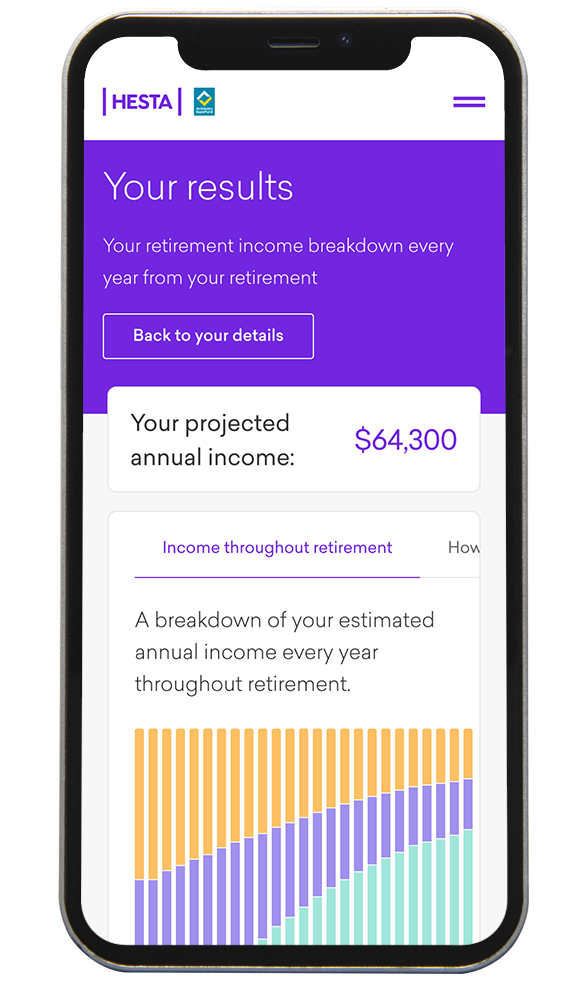

Our Future Planner tool can help you:

- see how much money you're projected to have in retirement

- see how your projected annual household income compares to the Association of Superannuation Funds of Australia (ASFA) comfortable retirement standard; and

- explore options to grow your super.

For illustrative purposes only.

join us at our path to retirement seminar

Our Path to retirement seminars explore how you can take advantage of your super before you scale back or stop working.

These sessions include tax tips and contribution strategies, go through how your super could provide you with an income in retirement, and much more.

Why choose HESTA for retirement?

We'll help you get ready so you’re set up to retire the way you want.